Unleashing Venture-Scale Impact in Women’s Health

Why the “other half” of healthcare finally deserves whole-hearted capital

Women make up half the world’s population, yet they remain consistently underrepresented in healthcare research, product design, and clinical evidence. In 2023, only 7.9% of the U.S. National Institutes of Health’s research budget was directed toward women’s-health topics. This imbalance continues to affect everything from female specific treatment guidelines (think: IUD insertion pain relief) to generalist topics like medication dosages to cancer treatment plans.

The cost of neglect is more than academic. It creates a measurable drag on health systems and economies alike:

- Chronic pelvic pain and endometriosis cost the U.S. up to $119 billion annually in direct care and lost productivity.

- Menopause‑related symptoms sap workforce participation, fuelling a global TAM of $18 bn today, forecast to hit $27 bn by 2030.

- Menstrual-related health issues, including painful periods and conditions like fibroids and ovarian cysts, cost the UK economy £11 billion (€13 billion) annually in reduced productivity.

Public funding gaps, now wider than ever, leave space for venture capital to step in. Private investors can help bring forward evidence-based, women-centered solutions that legacy systems overlook. Done right, these businesses can deliver both financial returns and meaningful scale.

To explore this opportunity, we propose looking through three core lenses:

- the lifecycle lens, which explores how needs evolve across a woman’s life

- the solution lens, which examines the types of products and services being built

- the distribution lens, which considers how these offerings reach women through different payment and access models

Together, these lenses offer a practical framework for building and backing the next generation of women’s-health companies.

Lens I: Evolving Needs Across the Female Lifecycle

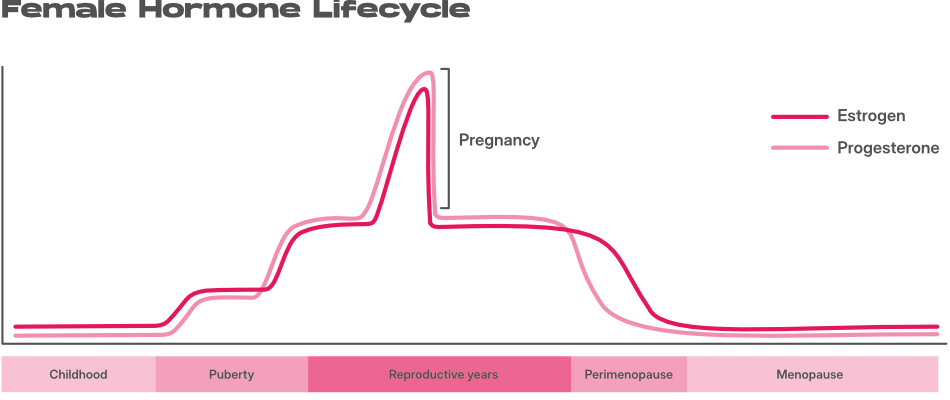

Health needs tied to female biology don’t unfold in a straight line. Some are constant companions, shifting subtly over time, while others flare up around major life events. We think of them in two buckets:

- Ongoing needs: recurring or long-term issues that morph with a woman’s hormonal cycle from puberty to menopause

- Point-in-time needs: Discrete but often intense and distinct episodes, such as pregnancy or fertility treatment

Ongoing Needs

- Endocrine & hormonal balance: From the first period through perimenopause, women navigate a multi-decade hormone rollercoaster. Whether intra-month fluctuations or more persistent imbalances, the impact ranges from mild discomfort to significant health challenges — including PCOS, metabolic issues and mental health problems. An estimated 80% of women experience hormonal imbalance at some point in their lives. Yet, the female endocrine system remains poorly understood, and interventions to reduce symptoms and improve quality of life are still limited.

- Cycle wellbeing & painful periods: Monthly cramps and heavy bleeding are more than nuisance; for roughly 1 in 10 women the root cause is endometriosis, a condition that costs European societies about €9600 per woman per year, two‑thirds of it lost productivity. Beyond this, countless women suffer (often silently) from PMS or PMDD related symptoms and yet more are faced monthly with the antiquated products to support their monthly cycle.

- Contraception & sexual health: Each woman has a unique multi-decade journey of how she prefers to manage her sexuality and if desired contraceptive needs. Priorities may unfold in myriad ways from managing hormonal side effects such as acne through to optimising sexual wellbeing through pelvic floor exercise. Yet today’s solutions often lack any degree of customisation and education, awareness and product development are stifled by physicians’ lack of knowledge and a lingering taboo or stigma on publicising the issue.

- Healthy ageing & longevity: After reproductive years, bone density, cardiometabolic risk and urogenital changes dominate, yet women are often dismissed and overlooked as they seek to manage female specific ageing symptoms.

Point‑in‑time solutions

- Fertility & family‑building: Europe’s total fertility rate slid to 1.38 live births per woman in 2023, the lowest on record. Paired with a rise in the average age of starting a family and growing prevalence of diverse family contexts, the path towards a baby has never been more fraught with challenges. These dynamics are fuelling demand for more support, new solutions incl. lower‑stim IVF protocols, egg‑freezing financing, and sperm or donor‑egg marketplaces.

- Pregnancy, birth & the ‘fourth trimester’: The physical intensity of pregnancy is mirrored by a mental‑health crunch: one in four women experiences a perinatal mental‑health condition, and England’s NHS saw 64 000 mothers use specialist services last year (≈10 % of all births). Support for women through motherhood, particularly as the current generations often juggle childcare alongside various other demands, is gaining increased air time as awareness for these challenges grows.

- Perimenopause & menopause: By 2030 more than 45 million women in the EU will be 50‑plus. A large UK cohort study of 3.000 women found that severe menopause symptoms made employees 1.4 × more likely to quit and 1.2 × more likely to cut their hours. Yet dedicated support and solutions remain limited, despite menopausal issues being one of the largest drivers of gynaecology visits.

Why the distinction matters

Whether a company is built around an ongoing or time-bound issue has significant downstream implications; particularly for go-to-market, business model, and product expansion strategy.

Customer lifetime, awareness levels, and urgency of the pain point vary dramatically. Point-in-time solutions, by nature, often benefit more acute needs. These are time-bound windows when action is more likely and willingness to spend is higher — making for powerful entry wedges: easier to market, easier to convert. But these windows close, hence businesses need to extract meaningful value quickly or find ways to extend the relationship through adjacent offerings.

Lifecycle solutions, by contrast, facilitate longer-term relationships and are well-suited to recurring revenue models (e.g. subscription) and broader mass-market appeal. But urgency is often lower and harder to manufacture, requiring sharper positioning, or more education. The upside? Once a lifecycle player earns trust, the opportunity for product expansion is vast.

In both cases, alignment is key: business model, go-to-market strategy, and monetization must reflect the nature of the need. That’s what unlocks strong economics and venture-scale outcomes.

Lens II: How Solutions Take Shape

Once the need is clear, the next question is what shape the solution takes and how it reaches users and payers.. We see three common formats in today’s market, albeit with blurred edges:

1. Product-led companies

These companies anchor their value in a tangible SKU: e.g. devices, diagnostics, or supplements.

- Elvie (UK) brought smart breast pumps and pelvic-floor trainers to market, generating £78 million (€89m) in revenue before a recent restructuring.

- Evvy (US) offers at-home vaginal microbiome tests, creating both user value and a proprietary data set.

- Looni (UK) sells monthly subscriptions for supplements designed to ease premenstrual symptoms.

Product-led models carry inventory risk and require up-front investment, but they also offer strong margins and defensibility through IP or brand.

2. Digital-first platforms

Here, the solution is delivered entirely online: via apps, virtual consultations, or self-guided therapy.

- Clue (DE) is a leading cycle-tracking app and recently launched a U.S.-approved digital contraception mode.

- Stella (UK) offers digital menopause programs that consumers or employers can purchase.

- Ferly (UK) is a sexual wellness app using guided audio and therapy-informed tools to improve pleasure and reduce pain.

These models scale quickly and are margin-friendly, but depend heavily on ongoing user engagement and clear clinical impact.

3. Service-led or hybrid clinics

The third archetype focuses on care delivery in the real world, supporting women through a physical in-person patient journey.

- Tia (US) runs integrated clinics for primary and gynaecological care.

- Elektra Health (US) provides menopause care through employer plans.

- Ovom (DE) offers hybrid fertility care combining in-person treatment with digital support.

These companies often command higher price points and retention, but require more capital and complex operations.

Expect the edges to blur

Many players with a physical service component will marry their proposition with a digital front door, facilitating digital care journeys between appointments. Equally, product-led businesses may seek to enhance the experience by layering digital solutions.These shifts reflect a broader truth: woman’s health needs are multi-faceted and the best companies grow by meeting women where they are. For instance, Elvie now layers coaching software on top of hardware and Tia licenses its clinic software to partners.

Why solution format matters

While each design archetype (and its hybrids) can address different categories of need, the interplay between solution and problem influences everything from pricing to scalability.

Digital products often lend themselves to hyperscale distribution: fast to deploy, low marginal cost. But their effectiveness hinges on how well virtual interventions can solve the specific problem. Physical products and offline services may seem less scalable at first: more capital-intensive and complex. Yet in many women’s health contexts, where the challenges are inherently physical, they can deliver superior results and justify higher pricing.

There’s no single winning format. The best companies are built on a smart match between the health need, the delivery method, and the model’s capacity to scale with trust.

Lens III: Who Pays and How Access Works

The last lens is about access: how does the solution reach women and who’s footing the bill?

The go-to-market model should not be an afterthought, but a first-principle design decision. Look to understand where women currently shop for health, who they trust, and how money flows. Channel strategy can unlock or bottleneck scale, particularly in European markets where out-of-pocket health spending is relatively low and payer complexity runs high.

We see three main go-to-market routes:

- Direct-to-consumer (D2C) models offer full ownership of the customer relationship. They can iterate quickly and build brand intimacy. Distribution spans from native e-commerce to established retail shelves, and suits high frequency use cases with emotional resonance, or community-building potential. However, European consumers are less primed to pay out of pocket, which can cap price points.

- B2B2C, especially via the employer channel, is gaining traction. While still nascent in Europe, market dynamics have driven HR departments to offer targeted women’s health benefits. These programs can be high-margin and sticky, with budgets to match. This route can unlock higher contract values and subsidised access to populations that may not otherwise self-pay. However, this route demands enterprise sales muscle and patience and ROI must be clearly measurable.

- B2Clinic2C plays, working through traditional medical providers, remain a critical channel, particularly for clinically adjacent or regulated solutions. Clinics often represent the first touchpoint for women in health decision-making, and clinical endorsement remains a powerful lever of trust. These pathways can enable companies to access public or private payer budgets and reach high-intent patients already primed for action. However, navigating reimbursement regimes can slow speed to market.

Seven Vectors That Shape Venture Potential

When evaluating a business, we look beyond the mission and into the mechanics. It's to go after a large addressable market (TAM) combined with a strong ratio of customer acquisition costs to a customer’s lifetime value (LTV/CAC ratio). Below are the most important actionable questions that help you to understand if you are building a venture scale business in the female health space.

| Vector | What it captures | Why it moves the needle |

|---|---|---|

| Share of population affected | The percentage of women who face the condition in a given geography. | High prevalence signals a large addressable market and stronger public-health tail-winds. |

| Recurrence of purchase / engagement | How frequently or long the user is likely to interact with the product or service. | High recurrence supports both market size (all else equal higher frequency drives higher TAM) and LTV; low recurrence must be offset by bigger basket sizes or mass adoption. |

| Awareness level | The extent to which the target user already knows she has a problem and is searching for help. | High awareness lowers education spend and hence increases adoption (bigger TAM) and lowers CAC; low awareness can still win if the adoption trigger is urgent (e.g., fertility window closing) or absolute margin capture is high to offset acquisition cost. |

| Price point / willingness to pay | What the end-user, employer, or insurer is ready to spend for a single cycle of value. | A high willingness to pay enables richer unit economics but demands stronger proof of outcome; low willingness must be offset by low acquisition costs and mass market appeal to drive large TAM. |

| Gross margin profile | Percentage of revenue left after direct costs (manufacturing, lab fees, clinician time). | High margins create room for marketing, evidence generation, and margin compression during scale-up; low margins require operational excellence or defensive IP. |

| Customer acquisition cost | All-in marketing and sales spend to win one paying user or contract. | A sustainable model recoups acquisition cost within a timely manner. Excessive spend signals weak product-market fit or crowded channels and can kill your ability to address a large enough % of your TAM to gain venture scale. |

| Sales cycle length | Time from first contact to revenue: days for a consumer check-out, months for an employer contract, years for public procurement. | Short cycles accelerate feedback loops and cash flow; long cycles demand patient capital and need to be offset by high value contracts to ensure ROI. |

Strong companies rarely tick every box perfectly. But founders who map these vectors early can design their business to match the permutations that allow for venture scale. Combine lower value price points with large markets and viral growth channels (high percentage of population affected, high awareness, low CAC) and ensure smaller problem spaces are compensated for by highly valuable products so that $ value can offset lack of volume. Most importantly revisit them as you expand to ensure you deliver lasting value and stand up to real-world complexity.

This article was co-authored with our syndicate member Daphne Dovermann, whose deep domain expertise and sharp insights into the women’s-health space shaped every part of the thinking presented here. As an investor & operator, she’s deeply passionate about supporting founders and always looking for ways to connect with the next wave of game changing builders.

At Cash & Carry, we’re excited by the next generation of women’s-health ventures—especially those that combine clinical credibility, thoughtful design, and clear distribution. We haven’t yet backed a company in the space, but we’re actively looking. If you’re building with conviction and clarity, we’d love to hear from hi@cashandcarry.cc.